This article is published as part of Skytrain – a transatlantic investor community bridging the gap between investors and VC funds in the US and Berlin. Learn more about the legacy of skytrain here.

Skytrain is part of Silicon Allee. We invest in deep tech startups and support them in developing their technology with one of Germany’s most renowned research institutes, Fraunhofer HHI.

Learn more about our startup offering here.

Running a venture capital fund can definitely be a challenge. In fact, one of the biggest challenges of running a VC fund or SPV is the insane amount of paperwork and back office support that goes into it. Add the deviously complex German administration system to the mix and you’ve got a recipe for a headache.

There are many problems:

- You need to stay up to speed on all the market trends and new technologies so you will know all about the companies you invest in and make sure they’re growing profitably and staying relevant in their industries.

- You need to know who to bring on as partners, service providers, co-investors and supporters so you can execute on your vision and build a team that will get things done.

- You need to know how much money you should be setting aside for each deal, calculating valuations, returns, capital calls from LPs so that your money arrives, is deployed and returns on time and hopefully above the industry average.

- You have to deal with the day-to-day operations, be able to manage your time well and ideally handle a flood of investment deals while keeping track of many moving parts. It’s easy for things to get lost in the shuffle when you’re juggling so many different tasks at once!

Luckily, there are many savvy software providers out there who’ve lept in to save the day and specialize in solutions for venture capital funds and special purpose vehicles (SPVs).

In our search we’ve turned up quite a few – they’re definitely not all perfect so, as this article is a part of the Skytrain project, we’ve added a note for each about the compatibility for US – EU investing.

(Please note, the below are not in ranking order)

1. AngelList

It just wouldn’t be right to make this list without mentioning one of the OG innovators in this space, AngelList. AngelList’s mission is pretty simple: “To increase the number of successful startups in the world”.

They have an array of different products available for investors, fund managers and founders and we encourage you to take a look as they keep adding more. Also take their clever Fund Calculator tool for a spin.

Here, we’ll take a look at the 2 products that we found most relevant and innovative for German VC funds and SPVs.

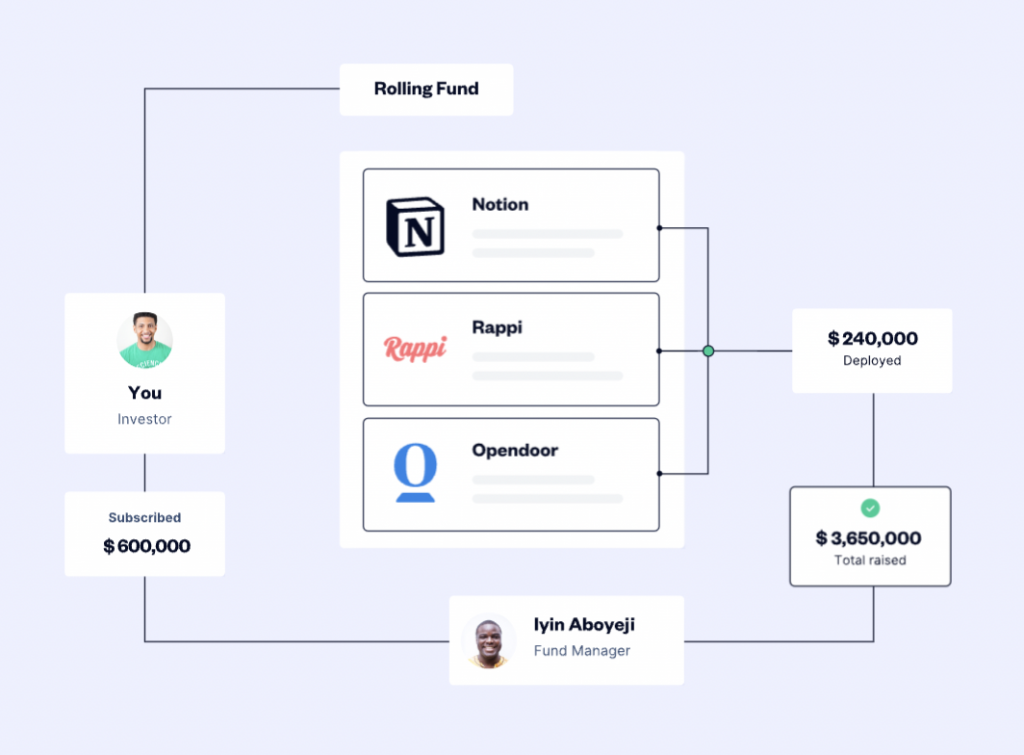

Rolling Funds

AngelList’s Rolling Funds are open-ended venture capital funds that allow LPs to subscribe on a quarterly basis. AngelList is the only service who has been able to figure out the legal complexity of this type of fund and turn it into a product so far. The always-on quarterly subscription model means fund leads can continuously accept new capital and LPs get a quarterly investment schedule rather than a one-time commitment to a fund. That means that LPs can very easily commit more or less capital as their investment goals change but should likely allocate it across every quarter. The reasoning we have found is, for example, if the LP invests in Q1 but not in Q2 and a company is funded in Q2 that goes on to be a unicorn the LP sees no returns from supporting the fund.

Syndicates

AngelList’s SPV solution will handle all the back office stuff (legal formation, capital calls, tax documents, etc). The major advantage to setting up a syndicate though AngelList is the potential to open your deals to their Private Capital Network and the general network containing big name VCs like Sequoia Capital, Andreessen Horowitz, Khosla Ventures, Founders Fund, as well as thousands of smaller LPs. They have a large pool of accredited investors you can tap into with minimal effort.

Bottom Line for Skytrain

Unfortunately, AngelList is pretty US-centric. Funds and SPVs are based in the US and subject to US tax and securities laws. That means that US or German GPs can create a fund for investing in Germany, but no German LPs could join the syndicate. The same would go for any deals outside the US or UK. In fact the only deals with no restrictions would be British and American. We have seen investors pair an AngelList syndicate with an EU syndicate for SPV deals and other creative “feeder fund” setups but it remains to be seen if that complexity is worth it for the cheaper costs and network of AngelList.

2. Carta

Carta is an ‘everything but the kitchen sink’ platform that helps founders and investors manage their cap tables, valuations, investments, and equity plans. While they started out with and are well known for their cap table management software, they have branched out into offering funds and SPV products for VCs.

Fund setup and admin services

Carta can take care of all the back-office needs, onboard LPs and keep them up to date with performance data and reports. They will also set up your fund with their partners for a competitive price.

Valuation services

They basically allow you to produce audit-ready ASC 820 valuations on your own with a self-service tool. The valuations are all ‘audit-ready and give an accurate and fair value of investments.

SPV management

Carta helps you customize your legal documents, forms the entity, helps you to open a bank account, onboards your investors, and runs the initial capital call for your SPV.

Their SPVs include unlimited capital calls and distributions, financial reporting, streamlined tax prep, and an LP portal so you can keep your investors in the loop.

Bottom Line for Skytrain

Like AngelList, Carta are mostly US-focused so support for creating an EU fund isn’t readily available. In the same way, you can create a US-based fund that will invest in Germany, but this may not be worth the reporting costs in both countries. All this may soon change with the recent announcement of their purchase of Vauban, an EU-based solution (see below).

3. Vauban.io

Recently acquired by Carta, Vaban’s claim is “we take the admin out of launching your funds and SPVs” – and it seems like they live up to their promise.

One of the first movers to offer Fund-as-a-Service offerings in Europe, Vauban makes it easy to launch your VC funds, SPVs and syndicates in hours, instead of months. They automate your legals, financial reporting, banking & LP onboarding.

While being slightly more expensive than their American counterparts (mostly due to their regulatory and reporting requirements) they are really pushing the envelope in venture software in Europe.

Bottom Line for Skytrain

The biggest benefit of Vauban (in our humble opinion) is that they’re EU-based. They’ve taken all the learnings of Angellist and Carta and finally made them available in Europe (at least UK and Luxembourg, which is a good start).

Vauban have quite a few articles on their site covering deal-by-deal SVPs, syndicates, the KYC process and VC/PE funds – you can read them here. They also have a very helpful and engaging customer service department.

4. Odin

Odin claims they make it 10x more efficient for anyone, anywhere to launch an angel syndicate or venture firm, powered by SPV’s (special purpose vehicles) incorporated and operated in the UK.

Odin SPVs allow syndicate leads to:

- Pool funds from multiple investors and buy shares in a startup. You can collect money from investors anywhere, and invest in companies everywhere.

- Charge carried interest and other fees to the other investors in the deal

- Enable proxy voting for the shares to a single individual (the syndicate lead)

- Distribute profits without any tax liability for the SPV itself.

They offer 3 different vehicles; Standard, Branded & Feeder Fund.

Apart from a slightly higher deal structuring fee, the only difference between Standard and Branded SPV is who’s name is on the cap table – with the Standard SPV it’s Odin.

The Feeder Fund SVP is something unique to Odin and of special interest to LPs or fund managers. It’s a way to roll up multiple investors into a single entity and invest in a fund as a single LP.

Bottom Line for Skytrain

The folks at Odin assured us that they can handle LPs from the USA as they take care of FATCA, tax, etc. So, Odin is a great solution for investors in the US to get easy access deals here in Europe. The only caveat for German investors is that they are still incorporating and basing everything in the UK, which as we know, while part of the continent is no longer part of the EU.

They have a really detailed FAQ page – you can find that here.

At the time of writing, Odin is live in private beta and accepting early users.

5. Allocations

Allocations claim to be “the fastest and most advanced SPV & Fund platform in the world” and we can see why.

After clicking a button “get started”, you’re launched straight into a form that requires you to fill out a few details: private market info, asset type, fund manager details, terms, and compliance. The whole process of setting up a deal is just 7 steps.

Bottom Line for Skytrain

After scouring their FAQ for fund managers and investors (which you can find here) and chatting with their support team, we found out that Allocations only offer SPVs filed in the US (Delaware and Wyoming). BVIs will be coming but they couldn’t give us any concrete timeline for that.

They can facilitate investments into European countries, but the SPV/Fund will still be US-based. So anyone looking for a more flexible way to tap into the European market (including European and US LPs) should look at one of the other solutions in this list!

6. Sydecar.io

Sydecar is another platform that’s designed to help venture investors start and run a fund or SPV. The idea is pretty simple. After you’ve lined up an allocation into a company’s funding round and have some prospective investors.

Just hook up a bank account and you can:

- Launch an SPV in a few minutes…

- Onboard investors in a few hours…

- And fund a company within a few days.

Sidecar handle all the back-office operations and provide a frictionless user experience for deal leads and LPs.

Bottom Line for Skytrain

At the time of writing Sydecar only creates Delaware-based companies, meaning your SPV or Fund will be US-based. They do claim to support investments in non-US companies as well as LP investments from non-US LPs, but have a vague warning that there may be tax and regulatory issues for non-US LPs and investments. We have a hunch the restrictions will look similar to AngelList’s.

They do have a lot of information about non-US entities in their FAQs here.

7. Flow Inc.

Flow is a platform for raising and managing SPVs, venture capital and private equity funds. Flow focuses heavily on efficiency by streamlining the workflows of raising and operating funds and connecting information across the various stakeholders.

They currently have three products in their portfolio:

- Investor Onboarding – a digital solution that simplifies onboarding and subscriptions for LPs, GPs and law firms into a fund.

- Investor Portal – a kind of CRM for managing the day-to-day business of VC & PE funds and SPVs.

- SPVs – Flow’s platform for the end-to-end creation and execution of SPVs.

Bottom Line for Skytrain

Flow is currently focused on administering SPV funds for US-domiciled investors. When it comes to investing in companies domiciled outside the US, they do give an overview of on their website with a possibility to speak with their sales team directly.

8. Assure

Assure specialize in SPV & PE fund administration boasting more than 14,000 SPVs or private transactions under their belt.

For funds, Assure offers admin, accounting and tax services.

For SPVs, they have three products that differ in size and scope:

Assure Labs – A fast vehicle for one-off, small raises.

Standard – A more flexible vehicle designed for small, medium & large raises.

Enterprise – A highly customizable structuring and administration service for larger ventures.

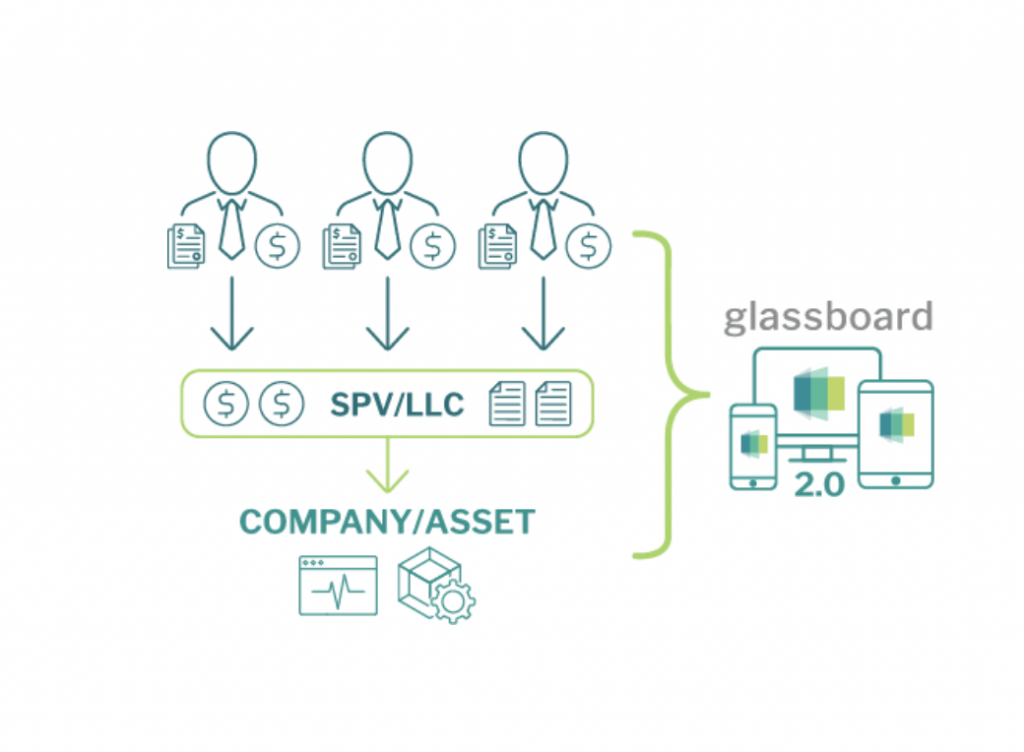

The notable thing about Assure is their in-house software platform, Glassboard, a private deal management platform for SPVs.

Bottom Line for Skytrain

When it comes to making connections and actually putting together SPVs for a syndicate, you’ll have to look elsewhere. Assure only specialize in looking after the back-office needs. The “back office” feature list is extensive though – including a proprietary software called “Glassboard” and all these buzzwords: SaaS, PaaS, white labeling, APIs, Special Purpose Vehicle administration, fund administration, fund accounting, fund taxes, banking, Exempt Reporting Advisor (ERA), KYC/AML, 506(c) accreditation, bookkeeping and financials. We were especially intrigued by the API offering.

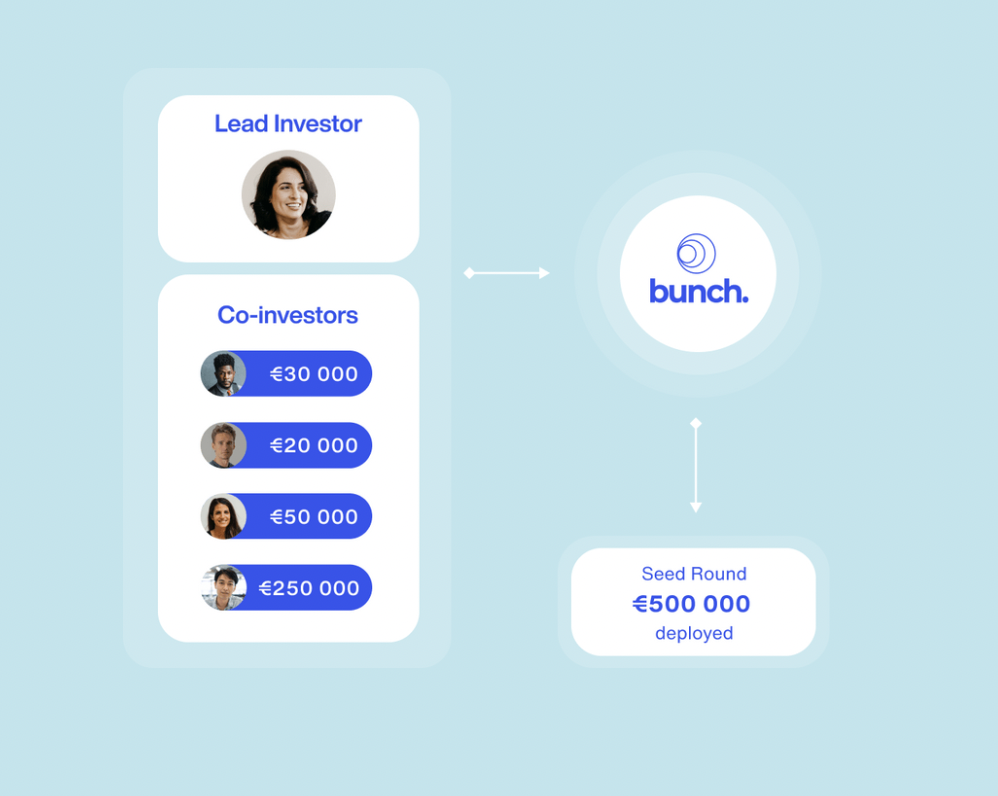

9. Bunch.capital

Bunch almost didn’t make this list because their site was offline during our initial research and while they secured their recent $7.8M investment. But we’re glad we caught them – because their software seems like exactly the tool we’ve been looking for. Plus, a big bonus is they are Berlin-based!

So what does Bunch do?

Buch claims to be a “one-stop shop for setting up & managing SPVs to pool co-investors, LPs or business angels”. Their goal is to remove the typical hurdles to private market investing (legacy intermediaries, overwhelming regulatory complexity, low-tech administration, etc.). They’re also teasing fund setup and admin in their menu bar, so we are sure they are working on offering this feature soon.

Their platform helps investors through the whole process from setting up the deal, to execution and through to managing the ins and outs of the deal.

Bottom Line for Skytrain

We found the following statement on the website, which got us a little giddy: “Don’t worry about regulations and taxation. Navigate the complexity of European private market investing with our compliant investment vehicles.”

After a chat with the customer services team, we’re happy to say they can most definitely help in streamlining the process for US-domiciled investors to put their money to work here in Germany. No word yet on the pricing so we can’t say how competitive it is to other providers.

10. Syndicate.io

Finally to round out this list is one for our crytpo kids and web3 wranglers. Syndicate offers a solution to create a Decentralized Autonomous Organization (DAO) – funded through token sales, issuing NFTs, and rendering revenue-generating services – that can then be used to invest in startup equity off-chain.

While Syndicate is mostly for pooling investors into on-chain assets like tokens and NFTs, they do offer off-chain investment into equity vehicles like startups. So, if you’re convinced of DAOs and want to try a really innovative investment setup, take a look at Syndicate’s offerings.

Bottom Line for Skytrain

As Syndicate’s on-chain investments are purely into digital assets, for now it looks like anyone can join and invest anywhere as long as it’s on-chain. Investing off-chain into startups, though, is a bit murkier. From digging through their FAQs and online posts it seems they’re only allowing investment into US companies for now. But stay tuned, as web3 heats up, this could turn out to be the most democratic and low-cost way for managing investment syndicates and funds.

So, that’s the 10 software providers for VC Funds and SPVs that we’ve found so far. It’s important to note that as SPVs become more and more accessible the market for managing and accessing venture deals becomes more and more competitive. We’re looking forward to seeing more platforms make it easier to get new fund managers investing into companies, especially in Germany!

Join the conversation on our twitter thread

View more from Silicon Allee

You might also be interested in:

- Inside NepTune’s Tech Development: Motion Capture with Fraunhofer HHI

- Why 90% of Research Never Becomes a Startup – And How Berlin’s New Model Is Changing That

- Building Deep Tech Startups in Berlin: Inside Silicon Allee at Fraunhofer HHI

- Girls Just Wanna Have Funds

- Tech Runs Deep, But Does It Run Diverse?

Interested in joining our transatlantic investor community?

Dieses Vorhaben wurde als Teil der Reaktion der Union auf die Covid-19-Pandemie finanziert.