This article is published as part of Skytrain – a transatlantic investor community bridging the gap between investors and VC funds in the US and Berlin. Join the network or learn more about what we do here.

Here’s a quick guide to German Venture Capital Funds for Foreign Investors

There are many reasons why Germany is the biggest economy in Europe and the fourth largest in the world. A competitive capital goods exporter, high purchasing power, and efficient vocational education system all contribute. But one of the most recent reasons for Germany’s economic prowess is its drive to become a hub of innovation.

Now, Germany is one of the brightest startup hotspots in the world. In 2021, over $100 Billion in venture capital was invested in German startups with Berlin becoming one of the most unicorn dense cities on the continent.

With all that growth, it’s no wonder that more and more investors are looking across the pond for their next big deal. But let’s face it. Germany doesn’t have the best reputation when it comes to streamlined bureaucracy. That’s where we come in.

In this article, we’re going to give you an overview of venture capital funds in Germany – how they work, what that means for international investors, and the best ways to put your dollars to work in the lucrative German VC market.

How are VC Funds regulated in Germany?

Venture Capital funds and other alternative investment funds (AIF) – domiciled or distributed in Germany – are regulated by the German Capital Investment Code (KAGB). It’s essentially the German version of an EU directive: the Alternative Investment Fund Managers Directive (AIFMD) – aimed at tightening up regulation of hedge funds, private equity funds and real estate investment funds.

But here’s the thing.

The German interpretation of this EU directive by the German Federal Financial Supervisory Authority (BaFin). Remember that acronym – it will come back later in this article and likely never leave you alone.

Anyway, the German interpretation of this EU directive is a tad stricter than that of most other EU countries. So a lot of German fund managers have historically taken a more international approach – and set up their funds either onshore (i.e., Luxembourg, the Netherlands, Ireland) or offshore (i.e., Guernsey, Jersey).

In this way they’re able to keep the door open for German investors by taking advantage of the European Alternative Investment Fund Managers Directive (AIFMD) Passport. The AIFMD Passport allows freedom to provide services in another Member State while circumventing some of the more restrictive elements of the KAGB.

However, newer legislation has removed many of the older hurdles, making investing in Germany that much easier – and more competitive.

The most common German fund structure

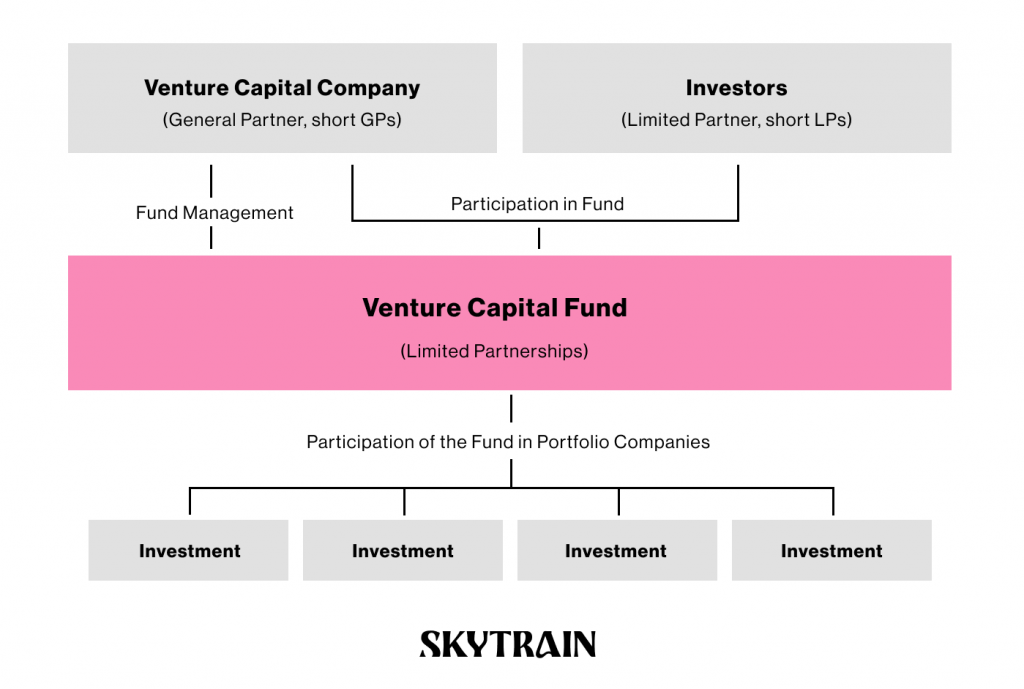

Just like the rest of the world, most venture capital funds are structured as a limited partnership (in German an investment KG) with carry vehicles and (in PE scenarios) management participation vehicles that pool the shares in turn. It’s tax-transparent, allows a flexible structure and provides limited liability to investors – a reassuringly similar setup to the American LLC fund structure.

The General Partner (GP) of the limited partnership – that’s the entity or entities making the funding decisions and managing the fund – is usually a German limited company (GmbH). The GP bears all liability for the fund’s debts and liabilities. In that case, the combination of limited company and limited partnerships becomes a GmbH & Co KG.

Investors joining the fund as Limited Partners (LPs) are only liable for the fund’s debts and liabilities to the extent of their capital contributions.

The Limited Partnership Agreement (LPA) – a document defining the terms of the partnership – will also look pretty similar to what you’re used to seeing. The only difference is that the German law does require some certain specifications.

The role of BaFin

Firstly the LPA (and other documentation like the investment policy, marketing documents, etc.) has to be approved by BaFin. On top of that, BaFin also regulates the valuation of a fund’s assets and all fund managers have to apply to them for authorization before any business can be done. The documentation required by BaFin depends on whether the fund/fund manager is domiciled in Germany, the EU (leveraging the EU Passport), or outside the EU.

Here’s how BaFin – rather cryptically – define the requirements on their website (translated from German):

“In order to obtain a license, capital management companies must, among other things, prove that they have at least €300,000 or €125,000 in initial capital, depending on the structure.In addition, they must have an appropriate organization and a reliable and professionally suitable management (solvency supervision). The market conduct of capital management companies is also monitored in accordance with the German investment law – KAGB– (market supervision).”

Managing Limited Partner

As well as the GP, a fund operating as a German Investment KG also needs an LP with management responsibilities, essentially the fund manager – called a Managing Limited Partner. The managing LP can be a GmbH, an individual or another German limited partnership.

By having a managing LP, funds can avoid having to create a permanent establishment – and the associated tax filing obligations that come with it.

Priority Profit Share

In place of the typical management of performance fee, a German limited partnership has to pay a priority profit share to the GP, managing LP, or both. In Germany it’s a lot tougher than – let’s say Luxembourg or the Channel Islands – to get VAT exemption. So, the priority profit share model creates some VAT advantages.

Forming a VC fund as KG or GmbH & Co KG

As soon as the LPA is signed by the GP and LPs, the KG (or GmbH & Co KG) is officially formed. The KG and its partners are also registered in the German commercial register to guarantee limited liability.

These filings and all signatures have to be notarized by a notary public and, outside of Germany, further officiated by an apostille – an official confirmation of the genuineness of a document which shows the exact match of a copy with its original document. Although it sounds like it could be expensive, the cost of all this is low – usually under €2000.

Marketing a fund in Germany

One of the biggest hurdles for non-EU VC fund managers comes in when it’s time to market the fund. Marketing the fund generally means soliciting capital. Usually this means sharing your fund prospectus with investors unsolicited. “Marketing” could be interpreted a bit more strictly though. The KAGB lumps private placement and public offering into one pot “marketing and distribution”. They define that as: “any direct or indirect offering or placement of fund shares to any type of investor”.

At the time of writing, the European Securities and Markets Authority (ESMA) is considering extending the AIFMD Passport (that agreement that allows free trading between EU nations) to a handful of non-EU countries, including the United States. But, until the law passes, non-EU fund managers will have to prove they comply with the AIFMD and the KAGB when applying for permission to market in Germany.

Here’s a list of the minimum requirements:

- A business plan, including information on the fund and the specified domicile of the fund

- Contractual terms and legal documents of the fund

- The name of the depositary

- A description of the fund and all required information to be disclosed to investors (e.g., prospectus and key information document)

Who can become a Limited Partner in a German VC?

The KAGB defines three categories of limited partners who can provide capital for a VC:

- Professional investors – banks, insurance companies, pension funds, etc.

- Semi-professional investors – includes companies, trusts, foundations, family offices with assets above €10 million and private investors who can commit an initial single investment of at least €200,000.

- Private investors – all those who do not belong to 1. and 2. Interestingly, this could (technically) also include retail investors who are regulated much more strictly to comply with consumer protection laws. Of course, retail investors – due mostly to the level of due diligence and local regulation – haven’t traditionally played a role in venture capital. But with new crowdinvesting regulations approved in the EU this year and the help of blockchain and crypto, we’re bound to see things change dramatically in the next few years.

Navigating the notorious German tax system

Going into detail on this would need a whole article for itself, but here’s the quick version for you.

General Taxation

The way a fund is taxed depends on whether it’s classed as an asset management fund or a business partnership. The simplest way to think about it is that an asset management fund is tax-transparent, whereas a business partnership is also subject to trade tax.

For foreign investors, that means investing in a German-domiciled fund could lead to you being taxed in Germany. So, make sure you check the structuring of the German fund – a non-German EU fund may be a safer bet!

So, for managers of non-German funds you’ll have to assess whether your legal set-up is comparable to a German partnership or corporation. The tax consequences could differ a lot depending on the result of this classification. Also it’s helpful for landing non-German LPs to have answers and solutions to their tax liabilities ready up front.

VAT

When the fund is structured as a limited partnership, management fees or priority profit share are both subject to 19% VAT. From our experience this also relates to the “services” offered by your fund. For example, funds who provide founders with additional resources like development help, sales help, coaching, mentoring, and the like are providing taxable services to their portfolio. Funds that strictly manage money can likely get around this requirement.

That’s not to say it’s the best move to forgo VAT. Sure, it’s an extra headache from an accounting perspective, but if built into the fund from day one, the value add of these additional services to portfolio companies can be worth the extra reporting.

Fund Location Act

On April 22, 2021, the Bundestag passed the Fund Location Act (FoStoG) with the goal of strengthening Germany as a fund location. Obviously, this was a very good thing for VCs in Germany.

Here are the most important highlights of the bill for VCs:

- Less bureaucracy and more digitalization. For example, a lot of required written forms (yes, we mean written – as in, signed with a pen) were dropped, saving investors costs.

- Closed-ended special AIFs. This vehicle means more flexibility, LPs no longer have to be entered into the commercial register, and venture capital funds can use the legal form of a special fund instead of the corporate form of a GmbH & Co. KG. Look out Luxembourg!

- The VAT exemption for the management service of investment funds was extended to VCs.

- Employees of startups got a higher income tax threshold on employee stock options (from €360 to €1,440/year). This can help to attract new employees, strengthen their position in the company and allow them a piece of the pie when the company’s sold.

The easiest ways for LPs to access the German VC market

With our Skytrain Network, it’s Silicon Allee’s mission to build a bridge across the Atlantic by demystifying German bureaucracy around investing for early-stage LPs in the US and connecting them with Berlin-based fund managers, founders and anyone else involved in venture capital.

In writing this article we had support from venture capital law experts at Schalast. Before you make any investment decisions, make sure you reach out to them for advice and tell them Skytrain sent you!

Article written by Andrew Wilkinson

Join the conversation on Twitter!

Interested in joining our transatlantic investor community?

Dieses Vorhaben wurde als Teil der Reaktion der Union auf die Covid-19-Pandemie finanziert.