The Bridge is a series of articles exploring connections between the European tech capitals of Berlin and London supported through our partnership with London & Partners.

With the new year ahead, we’re gathering inspiration from billion-dollar valued companies born from high-growth sectors in London, Berlin and Munich.

After a challenging 2020, we think it’s time for some much needed good news. We can start with the fact that European tech is still booming, exciting and transformative.

Setbacks aside, last year’s events have produced plenty of new success stories (hello, Hopin and virtual meeting platforms). We’ve also seen the results of long-term R&D and engineering come to fruition (Lilium, we’re looking at you). There’s been increased disruption of traditional banking, plenty of telemedicine and an explosion of e-commerce. Companies working on global challenges such as healthcare and climate change have continued to make strides toward sustainable solutions.

Germany and the UK have been fruitful grounds for the creation of Unicorn companies valued at over a billion dollars that have added much to the global conversation in the last twelve months. Dealroom reports that VC investment remained resilient in London and throughout Europe despite the pandemic; London and Berlin combined saw $13.6 billion of VC investment.

With the new year ahead, we thought it would be inspiring to look at the successful activity coming out of both regions. London currently boasts 43 unicorns and Berlin has 11. We’ve picked four unicorn-rich sectors we find especially fascinating right now. Dig in below and discover the companies that are on track to becoming the next global household names.

Transportation

In 2020, many of us considered it a good day when we were able to venture beyond our own living space. Although transportation quickly became more of an afterthought than the years prior, technology in the space has continued to boom.

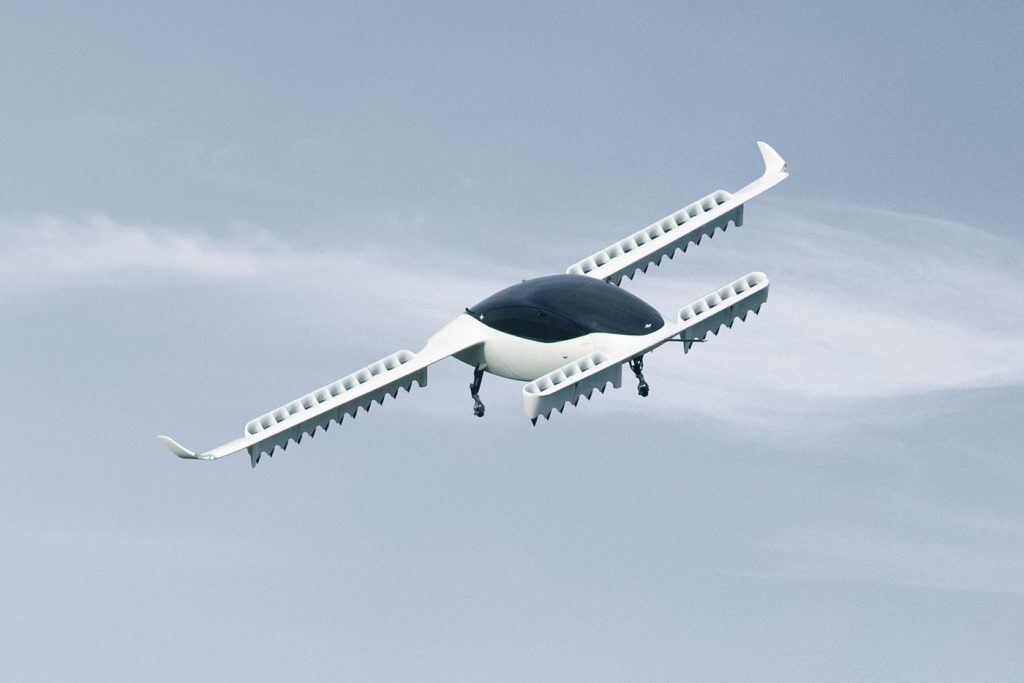

- Munich-based

Liliumturned heads at the start of the pandemic when it announced a $240 million round to continue developing its all-electric, vertical take-off and landing aircraft. By 2025, it intends to operate a regional air mobility service.

- Also based in Germany,

FlixMobility– parent company of the popular long-haul bus service, FlixBus – reported a 37% increase in passengers at the start of last year. The company, which operates in 30 countries, is now valued at over $2 billion and poised to grow further when regular travel resumes.

- London electric van maker

Arrivalemerged from stealth in early 2020 and is already valued at $3 billion, having received key investments from car companies Kia and Hyundai. Arrival’s mission is to create the highest standard of zero-emission vehicles with a current focus on vans, buses and the microfactories that build them.

Digital banking/Fintech

As more Europeans grow disgruntled with traditional banking services, digital banks and payments services continue to explode on the market. Earlier last year we wrote about the resilience of Fintech in the face of the pandemic, and here we list a few superstars that are quickly expanding in and outside of Europe to become global financial giants.

- Just named Europe’s most valuable unicorn at $15 billion,

checkout.comhas raised another $450 million for its online payments platform that also integrates analytics and fraud monitoring.

- Banking-as-a-service platform

Solarisbank, while still considered a future unicorn, raised €60 million with a vision of “contextual financing” – or integrating banking more closely into everyday life. Driven by younger generations’ needs for digital access to everything, Solarisbank empowers businesses to integrate banking into their operations.

- Berlin-based

N26is a digital banking veteran, having launched back in 2013 as the first bank of its kind. With 3.5 million subscribers in Europe, it is now vying for the US market. N26 has hit some rough patches over the years, but it continues to win over digital banking converts.

- Millennial users of digital banking app

Monzoclaim that they save more money when using the app. In hard times, that’s a huge driver for the company’s recent success. By offering a well-rounded banking experience without the typical hassles, Monzo has created a product worthy of its $2 billion valuation. We’re interested to see if Monzo can make up its losses in the coming years, as it launched with the disruption-first mindset that put revenue priorities in the backseat.

- Leading all the above digital banks in downloads and revenue is London’s

Revolut– the fastest growing digital bank in Europe. With 11 million users and a valuation at $5.5 billion, Revolut is at the forefront of the neobank revolution and plans to compete in the US market against N26.

Enterprise software

While not typically grabbing headlines like B2C, the B2B and enterprise sector is the backbone powering global industry and our European economy. The UK and Germany are fertile grounds for B2B, even during the pandemic, as evidenced by these growth success stories.

- Just eight months (!!) after launch, digital event platform

Hopinreached a $2.1 billion valuation. That’s not too surprising considering its impeccable launch timing, product-market fit and mission (“create virtual events that people love”). We’re curious to see how Hopin continues building on its incredible start moving out of the pandemic.

- Security and software engineering are both at the forefront of the tech world, now more than ever.

Snykhelps developers find vulnerabilities in their code, which reduces companies’ overall risk of innovation and operation. The London-based company has raised its Series D and is now worth $2 billion.

- Munich’s

Celonisis ramping up efficiency in IT process management for companies who are making an impact. Its clients include Vodafone, Siemens and Uber. With roots in Germany, Celonis now boasts a $2.5 billion valuation and 15 offices worldwide, including a home base at One World Trade Center in NYC for capturing the US market.

Health tech/Impact tech

London’s impact tech companies received record investment in 2020 – reaching $1.2 billion between January and October – and secured 429 total deals between 2015 and 2020. The sector also grew 280 percent during that time frame. All of this makes the city a global leader in impact tech deals, and a place to watch closely for the growth of this crucial sector. We’ve named a few more impact tech companies in our recent article here.

Babylon Healthhas made a name for itself with its online health consultation services and symptom checker app. Valued at $2 billion, its rise to success has accelerated during the pandemic. This is a company whose presence and bold claims have caused some friction among general practitioners and the healthcare community; nevertheless, this hasn’t stopped Babylon Health from finding its niche in the UK (and now in the US, too).

- Germany’s

CureVacis currently on Phase III trials for a Covid-19 vaccine, which may reach the manufacturing stage if it continues to prove both safe and effective.

- UK-based energy tech company

Octopus Energybecame a double unicorn to close out 2020. They also landed a major strategic partnership deal with Tokyo Gas, one of Japan’s biggest utility companies, to bring 100% renewable energy to one of the most competitive energy markets in the world. They also aim to make the UK the “Silicon Valley of energy”. They’re certainly on the right track.

For more good news and success stories, keep your eyes on this blog. We’ve got plenty coming up from our Berlin Founders Fund superstars.